There’s a lot of confusion in the market about what’s happening with day-to-day movement in mortgage rates right now, but here’s what you really need to know: compared to the near 8% peak last fall, mortgage rates have trended down overall.

And if you’re looking to buy or sell a home, this is a big deal. While they’re going to continue to bounce around a bit based on various economic drivers (like inflation and reactions to the consumer price index, or CPI), don’t let the short-term volatility distract you. The experts agree the overarching downward trend should continue this year.

While we won’t see the record-low rates homebuyers got during the pandemic, some experts think we should see rates dip below 6% later this year. As Dean Baker, Senior Economist, Center for Economic Research, says:

“They will almost certainly not fall to pandemic lows, although we may soon see rates under 6.0 percent, which would be low by pre-Great Recession standards.”

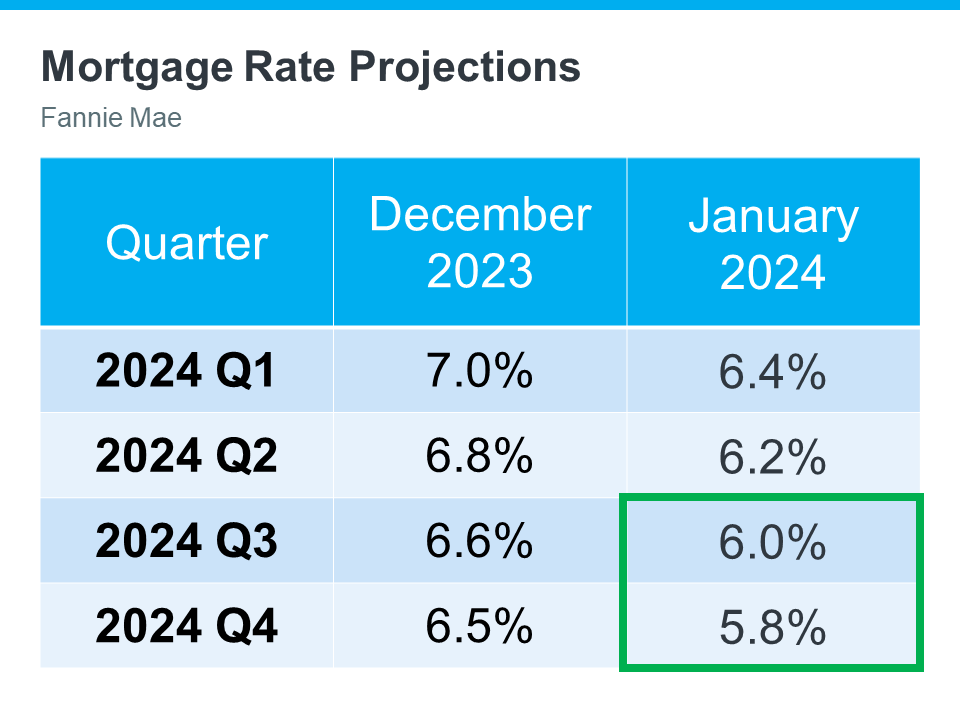

And Baker isn’t the only one saying this is a possibility. The latest Fannie Mae projections also indicate we may see a rate below 6% by the end of this year (see the green box in the chart below):

The chart shows mortgage rate projections for 2024 from Fannie Mae. It includes the one that came out in December, and compares it to the updated 2024 forecast they released just one month later. And if you look closely, you’ll notice the projections are on the way down.

It’s normal for experts to re-forecast as they watch current market trends and the broader economy, but what this shows is experts are feeling confident rates should continue to decline, if inflation cools.

What This Means for You

But remember, no one can say for sure what will happen (and by when) – and short-term volatility is to be expected. So, don’t let small fluctuations scare you. Focus on the bigger picture.

If you’ve found a home you love in today’s market – especially where finding a home that meets your budget and your needs can be a challenge – it’s probably not a good idea to try to time the market and wait until rates drop below 6%.

With rates already lower than they were last fall, you have an opportunity in front of you right now. That’s because even a small quarter point dip in rates gives your purchasing power a boost.

Bottom Line

If you wanted to move last year but were holding off hoping rates would fall, now may be the time to act. Connect with a real estate agent to get the ball rolling.