There’s been a lot of recession talk over the past couple of years. And that may leave you worried we’re headed for a repeat of what we saw back in 2008. Here’s a look at the latest expert projections to show you why that isn’t going to happen.

According to Jacob Channel, Senior Economist at LendingTree, the economy’s pretty strong:

“At least right now, the fundamentals of the economy, despite some hiccups, are doing pretty good. While things are far from perfect, the economy is probably doing better than people want to give it credit for.”

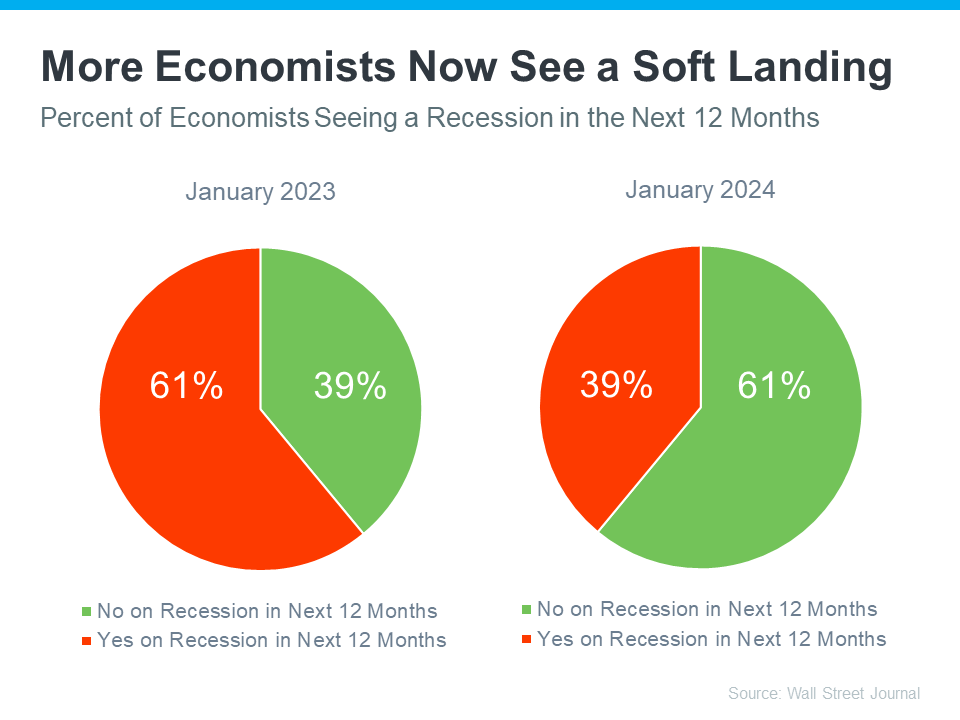

That might be why a recent survey from the Wall Street Journal shows only 39% of economists think there’ll be a recession in the next year. That’s way down from 61% projecting a recession just one year ago (see graph below):

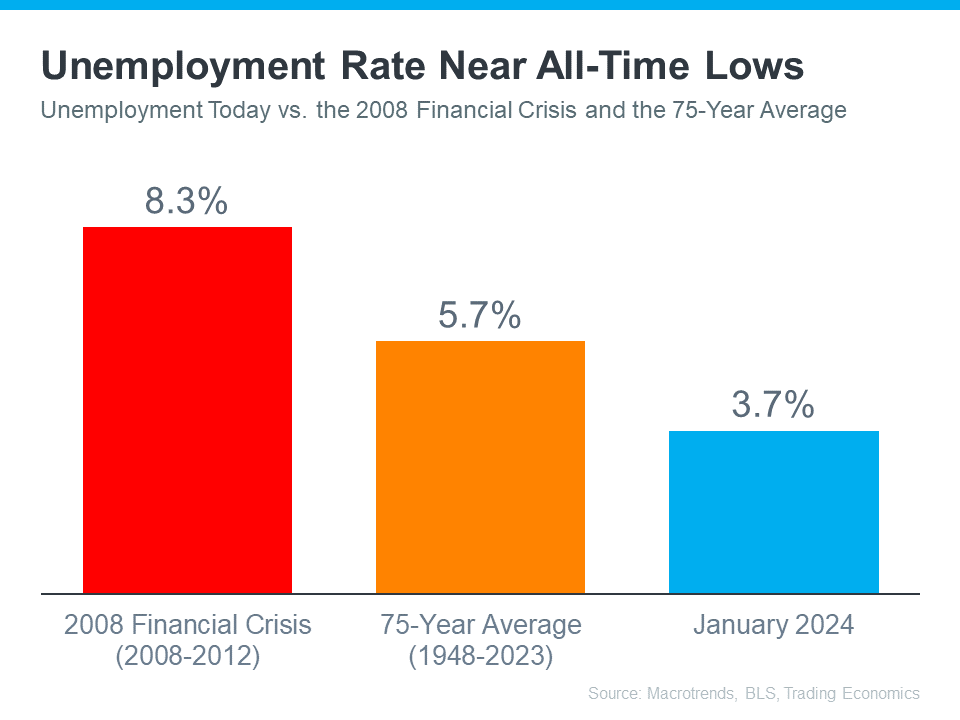

Most experts believe there won’t be a recession in the next 12 months. One reason why is the current unemployment rate. Let’s compare where we are now with historical data from Macrotrends, the Bureau of Labor Statistics (BLS), and Trading Economics. When we do, it’s clear the unemployment rate today is still very low (see graph below):

The orange bar shows the average unemployment rate since 1948 is about 5.7%. The red bar shows that right after the financial crisis in 2008, when the housing market crashed, the unemployment rate was up to 8.3%. Both of those numbers are much larger than the unemployment rate this January (shown in blue).

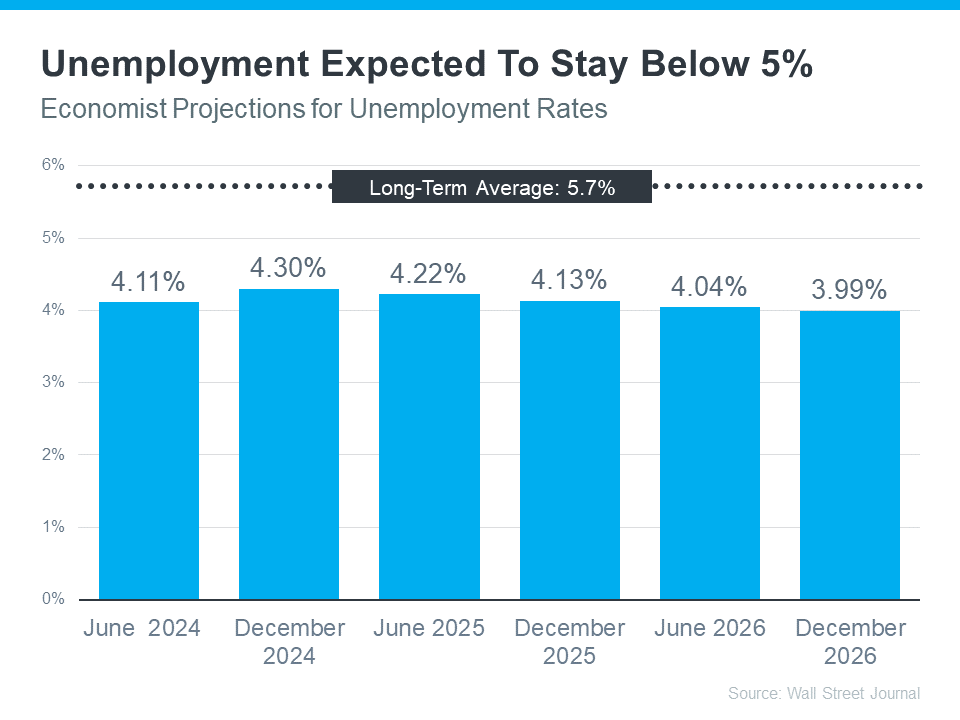

But will the unemployment rate go up? To answer that, look at the graph below. It uses data from that same Wall Street Journal survey to show what the experts are projecting for unemployment over the next three years compared to the long-term average (see graph below):

As you can see, economists don’t expect the unemployment rate to even come close to the long-term average over the next three years – much less the 8.3% we saw when the market last crashed.

Still, if these projections are correct, there will be people who lose their jobs next year. Anytime someone’s out of work, that’s a tough situation, not just for the individual, but also for their friends and loved ones. But the big question is: will enough people lose their jobs to create a flood of foreclosures that could crash the housing market?

Looking ahead, projections show the unemployment rate will likely stay below the 75-year average. That means you shouldn’t expect a wave of foreclosures that would impact the housing market in a big way.

Bottom Line

Most experts now think we won’t have a recession in the next year. They also don’t expect a big jump in the unemployment rate. That means you don’t need to fear a flood of foreclosures that would cause the housing market to crash.